The ESG Lab developed a methodological framework to calculate the carbon footprint (GHG emissions) of priority assets within a portfolio, focusing on photovoltaic panels (PV), heat pumps (HP), and insulation.

Why?

The approach provides a structured way to assess the climate impact of housing-related renovations financed through a consumer credit portfolio. By refining existing research and tailoring it to both internal and external data sources, the framework enables robust and scalable carbon footprint calculations.

• We integrated insights from internal partner datasets and complementary external sources, covering PV/HP energy generation and insulation performance.

• The methodology assesses feasibility, required data inputs, and underlying assumptions, while highlighting the strengths and limitations of different approaches.

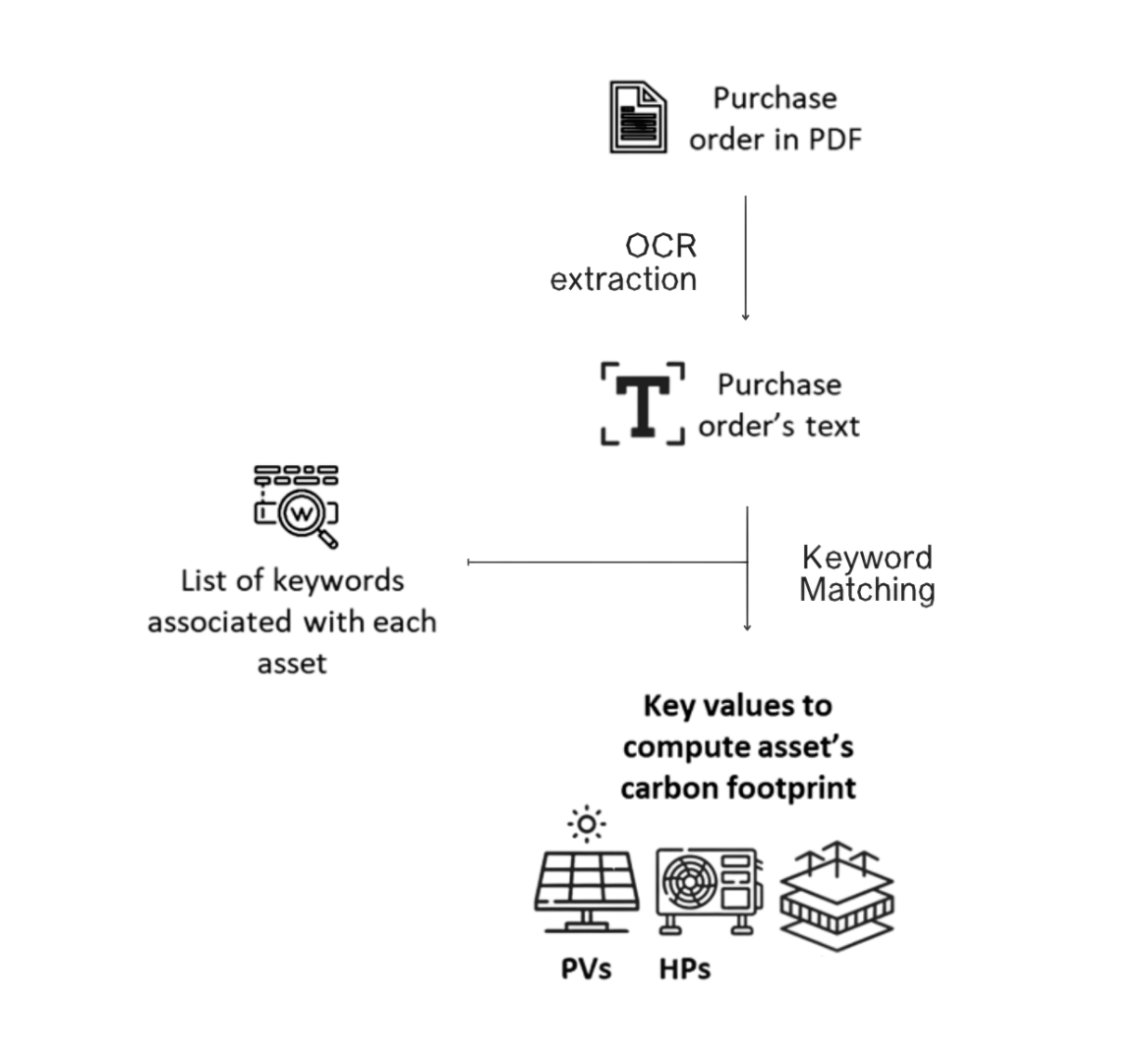

• To support operational implementation, we analyzed purchase orders across countries and asset classes, testing whether automated data extraction (notably OCR) could deliver reliable inputs. This included tests of different extraction tools and a subsequent review of available market solutions.

The result was a methodological roadmap, a granular assessment of data availability by country and asset, and practical recommendations on the use of automated extraction. This provides our partner with a solid foundation to calculate and progressively refine carbon footprints for PV, HP, and insulation assets in future project phases, while adapting to data quality and country-specific contexts.